Introduction The Income Tax Act 1967 ITA 1967 is the main source of reference governing the income tax system in Malaysia. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith.

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Semantic Scholar

Currently the ITA 1967 contains 13 Parts with 13 Schedules and 156 Sections.

. 1 Every appeal shall be heard by three Special Commissioners at least one of whom shall be a person with judicial or other legal experience within the meaning of. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. Several clauses highlight the requirement for a.

Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and reliable as a student text. And b thereafter where the members funds of such co-operative society as at the first day of the basis period for the year of assessment is less than seven hundred and fifty thousand ringgit. Part VI - Assessments And Appeals.

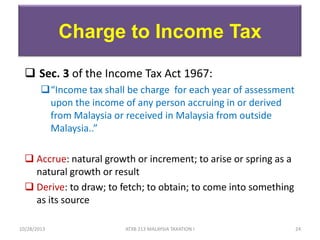

1 This Act may be cited as the Income Tax Act 1967. With effect from YA 2004 foreign source income derived from sources outside Malaysia and received in Malaysia by any person is not subject to Malaysian income tax. The Inland Revenue Board of Malaysia IRBM is one of the main revenue collecting agencies of the Ministry of Finance.

Part V - Returns. Individual Introduction Individual Income Tax What is. Laws of malaysia reprint published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with malayan law journal sdn bhd and percetakan nasional malaysia bhd 2006 act 53 income tax act 1967 incorporating all amendments up to 1 january 2006 053e fm page 1 thursday april 6 2006 12.

The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income. The Income Tax Act 1967 Akta Cukai Pendapatan 1967 is a Malaysian laws which enacted for the imposition of income taxwikipedia 10 Related Articles filter. Rules and legislative notifi cations relating to income tax have also been reproduced or.

Part II - Imposition And General Characteristics of The Tax. Part IV - Persons Chargeable. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 53Schedule 5.

Short title and commencement. Federal Legislation Portal Malaysia or Income Tax Act 1967 Copy. Section 2 - individual - company - unincorporated body of person Hindu joint family - body of person trust club trade association co-operation societies etc Question 2 Explain the following.

Schedule 4A of the Income Tax Act 1967 allows a person carrying on an approved agricultural project to elect so that the qualifying capital expenditure incurred by him in respect of that project is deducted from his aggregate income including income from other sources. Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a student text. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment.

The Malaysian Transfer Pricing Guidelines explain the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules 2012. Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia.

The ITA 1967 was first enacted in 1967 and frequently amended to accommodate the rapid development in Malaysian taxation. Income tax rules and legislative notifications have been reproduced or summarised in an easy-to-read table format. 1 This Act may be cited as the Income Tax Act 1967.

However any payment made which falls within the definition of royalty under Section 2 of the Income Tax Act 1967 would be subject to WHT. Income Tax Act 1967. 28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and.

Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 532Interpretation. 7 ITA 1967 - Residence Individuals Residence. 1 This Act may be cited as the Petroleum Income Tax Act 1967.

Section 12 of the Income Tax Act 1967 is about the determining the source of income or derivation of income. Part VII - Collection And Recovery of Tax. A preferential tax rate of 3 will apply to the Labuan entity on its net profits from Labuan business activities if it meets the substantial activity requirements otherwise it will be subject to a tax rate of 24 on its net profits.

Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. - In addition WHT is also applicable to any payments for special classes of income which includes technical and non-technical services.

2 This Act shall extend throughout Malaysia. BASIS AND SCOPE OF MALAYSIAN TAXATION Question 1 List any four chargeable person s under the Income Tax Act 1967. - Digital service is not defined in the Malaysian Income Tax Act 1967.

Part III - Ascertainment of Chargeable Income. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. 1 The income of any co-operative society- a in respect of a period of five years commencing from the date of registration of such co-operative society.

This volume contains the full text of the Income Tax Act 1967. Get Assignment HelpIncome Tax Act 1967 stated about a foreign worker or person entitled to have tax resident status in Malaysia under section 7. The tax exemption is stated in the Schedule 6 Paragraph 28 of the.

Part I - Preliminary. It governs the standard and rules based on the arms length principle to be applied on transactions between associated persons. 1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for a period or periods amounting in all to one hundred and eighty-two days or more.

Schedule 5 Section 102 Appeals.

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

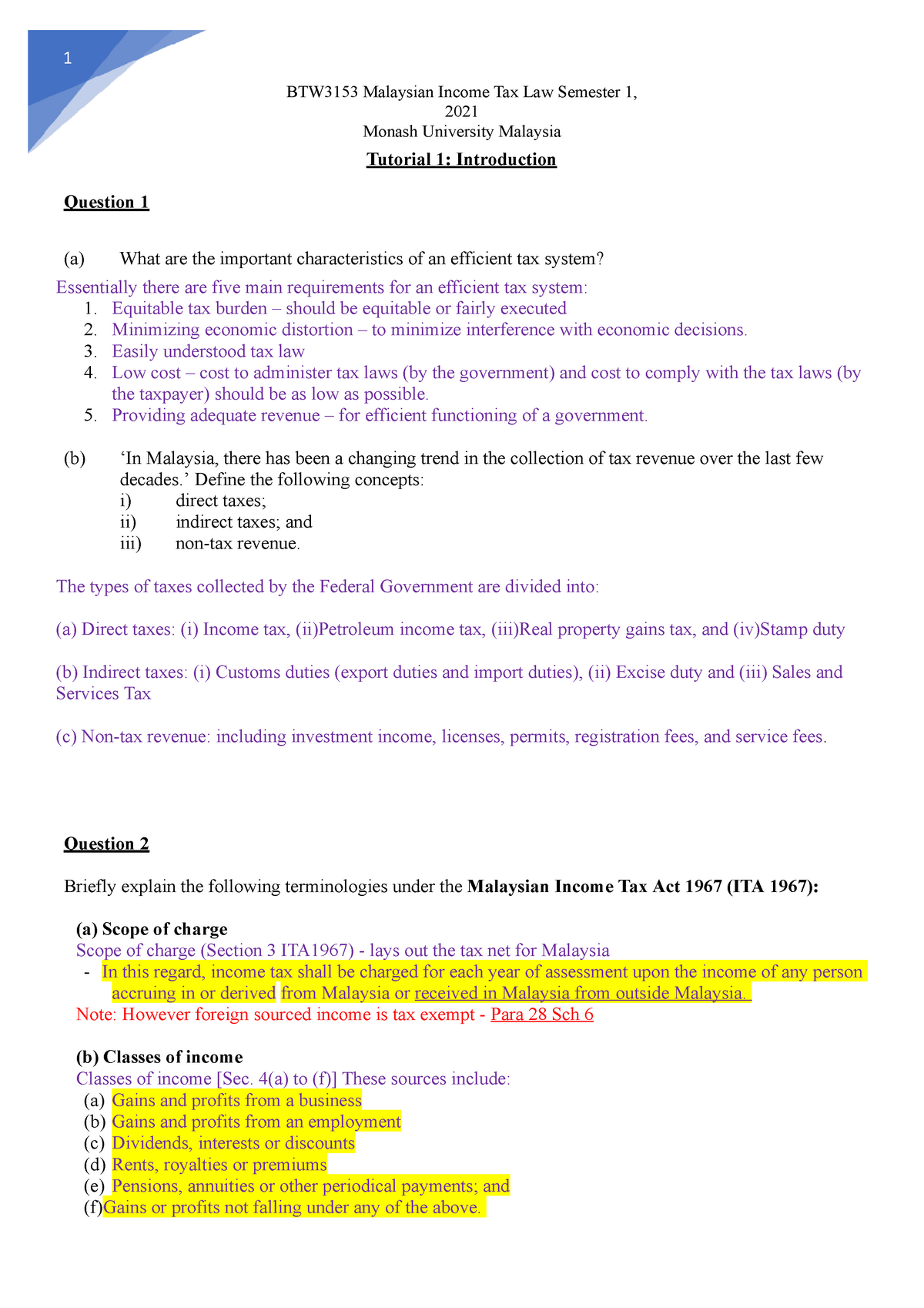

Tutorial 1 Btw3153 Week 1 1 Btw3153 Malaysian Income Tax Law Semester 1 2021 Monash University Studocu

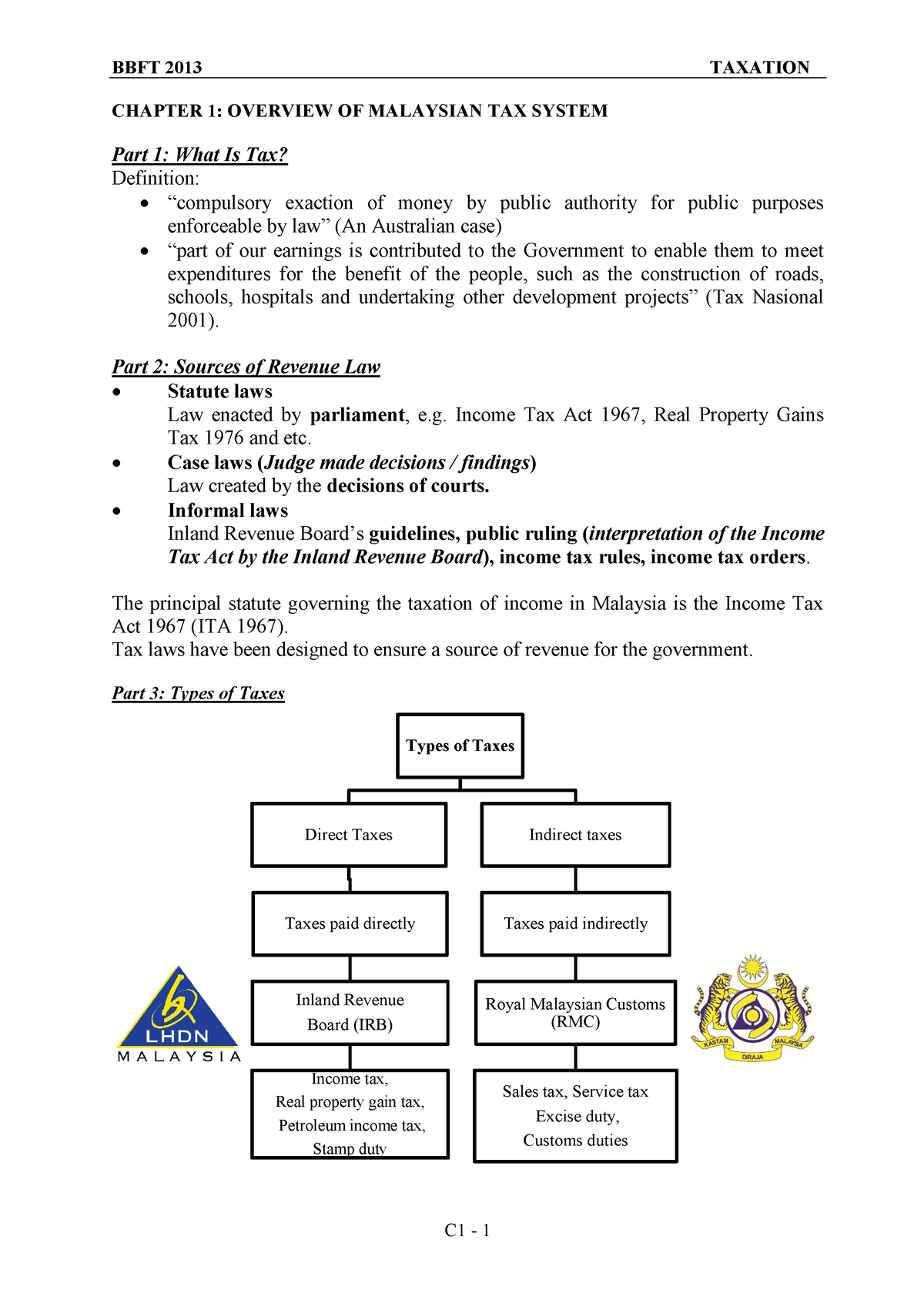

Chapter 1 Overview Of Malaysian Tax System Chapter 1 Overview Of Malaysian Tax System Part 1 Studocu

Ktps Consulting Withdrawal Of Withholding Tax Exemption Facebook

Laws Of Malaysia Income Tax Act 1967 Revised 1971

As An Employer What Are Their Obligations In Terms Of Income Tax

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition

How Much Does It Cost To Develop A Law Firm Mobile App Development App Development Mobile App Development App Development Cost

Malaysia Income Tax Act 1967 With Complete Regulations And Rules 9th Edition Taxation New Releases

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Chapter 6 Business Income Students

Buy Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 10th April 2022 Law Books Malaysia Joshua Legal Art Gallery

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

Tutorial 1 Tutorial 1 Introduction To Malaysian Taxation Amp Tax Residence Of Individuals Studocu

Best Payroll And Tax Services In Switzerland

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment